Frequently Asked Questions

What is a pawn?

If you’re in need of cash, we hold items as collateral. Examples of such items include, gold, silver, other precious metals, tools jewelry, music equipment, electronics, etc. Anything of value can be held as security that you will pay back the loan you receive.

Is there a credit check?

A credit check is unnecessary when it comes to pawn loans. Providing an item as collateral removes the need of determining a high risk or low risk loan. As long as the pawn loan is paid within 30 days with interest or extend the loan for as long as you need, the risk is eliminated.

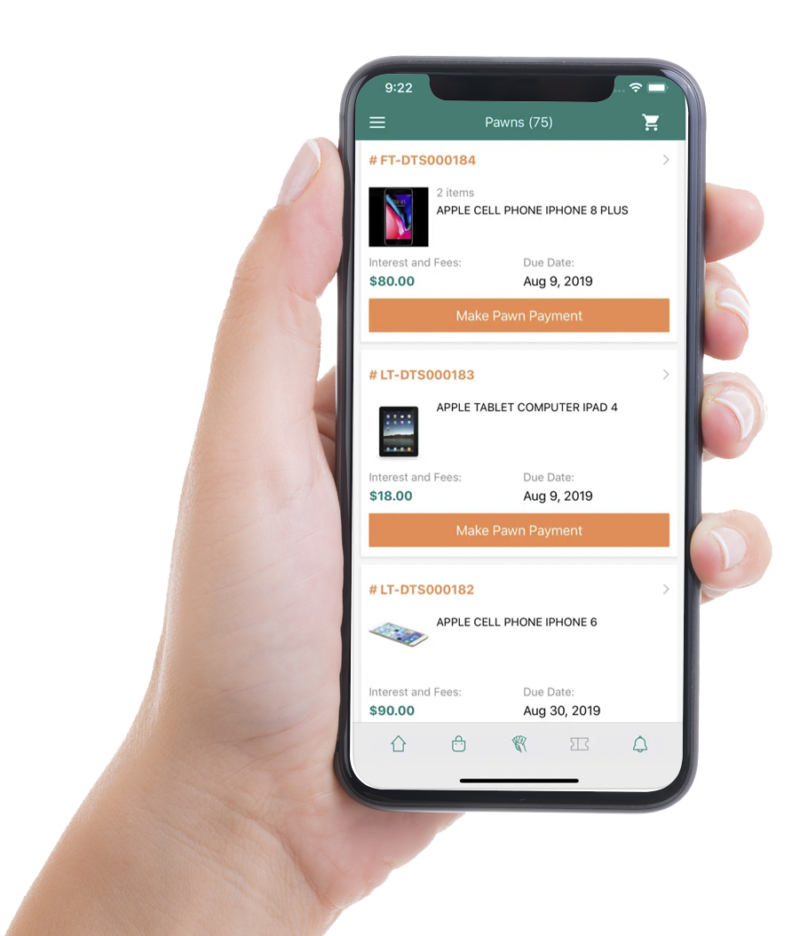

What are pawn tickets?

Pawn tickets are important for every pawn transaction as they include detailed information about the loan. These tickets include the item pawned, amount borrowed, interest date, maturity date, the amount due to bring home the item from pawn and/or the cost of extending the loan.

What if I can’t afford to pay off my loan?

A pawn loan can be extended for as long as needed until it can be paid in full.

Is the property I’ve pawned safe?

Yes, every item in our possession is treated as if it were our own. Each of our locations is fully insured and backed up by 24 hour monitored security systems.

What forms of identification can be used to pawn or sell?

By law, any form of government issued identification can be used to obtain a loan or sell an item in any pawn shop.

How do you we determine the loan amount for your item?

Our professional pawn specialists base pawn loan amounts on the value of your item, its current appraised value, its current condition, and our ability to sell the item. We use all the research tools we have at our disposal to determine an item’s value and get you the most money we can. The amount of the loan offered is based on the wholesale, resale/secondhand value of the item, not the new price.